vehicle personal property tax richmond va

Virginia taxes your automobiles every year as a property tax. Broad Street Richmond VA 23219 Hours.

Chesterfield Residents Get More Time To Pay Property Tax Grace Period Through July 29 Wric Abc 8news

Admissions Lodging and Meals Taxes Online Payment Parking Violations Online Payment Real Estate and Personal Property Taxes Online Payment 900 E.

. So if your car costs you 25000 you multiply that by 3 to get your tax amount of 75000. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800.

Sales Tax State Local Sales Tax on Food. We are open for walk-in traffic weekdays 8AM to 430PM. The total combined income from all sources of the taxpayer spouse and all occupants living in the home may not exceed 20000 in the year preceding the tax year for which assistance is requested.

Vehicle sales and use tax is 3 of the sale price. In this largely budgetary function county and local public directors project yearly spending. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief.

Trending on papergov Pay Property Taxes Pay Parking Citation Apply for Medicaid Pay Utility Bill Renew Business License. Once market values are assessed Richmond together with other in-county public units will set tax rates alone. Personal Property Tax Relief 581-3523.

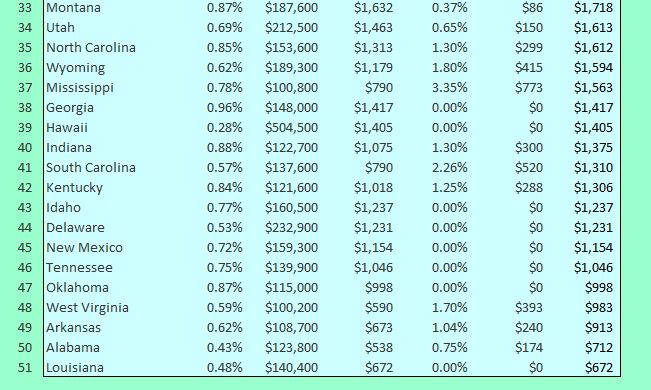

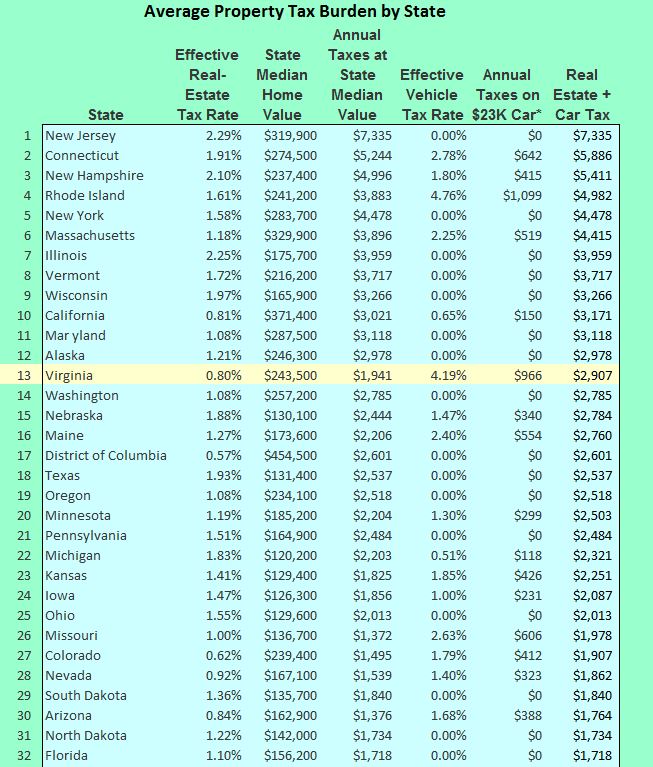

An example provided by the City of Richmond goes like this. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Purchases of vehicles and disposal of vehicles are required to be reported to the Commissioners Office within 30 days of either the purchase or disposal and not later than January 31 of each year following.

12000 Government Center Parkway Suite 223. Sales Tax State Local Sales Tax on Food. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief.

Personal Property Tax. Real property tax on median home. Commissioner of the revenue means the same as that set forth in 581-3100For purposes of this chapter in a county or city which does not have an elected commissioner of the revenue commissioner of the revenue means the officer who is primarily responsible for assessing motor vehicles for the.

Ad Find Richmond County Online Property Taxes Info From 2021. A 10 late filing fee may be charged for late filings or no notifications after January 31. Monday - Friday 900 am - 300 pm Physical Address 1300 Courthouse Road 2nd Floor Stafford VA 22554-1300 Mailing Address PO Box 98 Stafford VA 22555.

Broad Street Richmond VA 23219 Hours. Richmond City Virginia Property Tax Go To Different County 212600 Avg. Monday - Friday 8am - 5pm Mayor Levar Stoney.

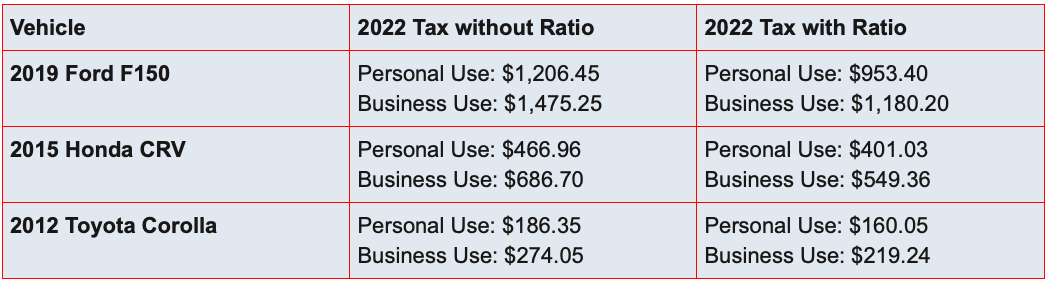

Virginia taxes your automobiles every year as a property tax. This measure cost the county over 7 million. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons.

WWBT - As Richmond residents see an increase in their personal property tax bills Richmond City Council has extended the due date for the payments. If your vehicle is valued at 18030 the total tax would be 667. Personal Property Staff Phone.

Property Tax Vehicle Real Estate Tax. Real property tax on median home. Personal Property taxes are billed annually with a due date of December 5 th.

Unsure Of The Value Of Your Property. Circuit Court Clerk for the City of Richmond VA. Find All The Record Information You Need Here.

If you have questions about your personal property bill or would like to discuss the value assigned to your vehicle please contact the Department of Finance by phone at 804 501-4263 email at taxhelphenricous or fax at 804 501-5288. On Tuesday the council voted to. As used in this chapter.

Personal Property Taxes are billed once a. 540 658-4120 Email Live Chat Office Hours. Personal Property Tax Rates Vehicles Autos trucks motorcycles and utility trailers are assessed on a prorated basis using the National Automobile Dealers Associations Blue Book NADA.

703-222-8234 TTY 711. Is more than 50 of the vehicles annual mileage used as a business expense for federal income tax purposes OR reimbursed by an employer. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

Monday - Friday 8am - 5pm Mayor Levar Stoney. 105 of home value Yearly median tax in Richmond City The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Monday - Friday 800 am - 430 pm Phone Hours.

A composite rate will generate counted on total tax receipts and also generate each taxpayers assessment amount. This will be a continuous tax to figure in your costs. Is more than 50 of the vehicles annual mileage used as a business.

At the calculated PPTRA rate of 30 you would be required to pay. This will depend upon the value of the car at the first of the year. Use our website send an email or call us weekdays from 8AM to 430PM.

Richmond City collects on average 105 of a propertys assessed fair market value as property tax. Cut the Vehicle License Tax by 50 to 20. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year.

Answer the following questions to determine if your vehicle qualifies for personal property tax relief. Is more than 50 of. Richmond City collects on average 105 of a propertys assessed.

In total the county returned 30 million to taxpayers to mitigate the. If a vehicle is subject to the taxes in Alexandria for a full calendar year the tax amount is determined by multiplying the tax rate by the assessed value. Ad Avoid Costly Mistakes with Professional-looking Legible and Error-free Legal Forms.

However the first 4000 of income of each occupant excluding the spouse living in the home with the homeowner may be excluded in computing income.

Pay Online Chesterfield County Va

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

Real Estate Investment Analysis Template

Richmond Extends Deadline To Pay Personal Property Taxes Wric Abc 8news

Henrico County Announces Plans On Personal Property Tax Relief

Virginia Localities Pushing Tax Relief As Car Values Go Up Dcist

News Flash Chesterfield County Va Civicengage

Personal Property Tax Deadline For Goochland Residents Extended With Interest Payments Penalties Waived Wric Abc 8news

News Flash Goochland County Va Civicengage

Many Left Frustrated As Personal Property Tax Bills Increase

Virginia Property Taxes Not As Bad As Jersey But Worse Than D C Bacon S Rebellion

/cloudfront-us-east-1.images.arcpublishing.com/gray/4ASPKZIKKZEKDBCSG3BYAZNXBM.jpg)

Richmond Personal Property Tax Payment Deadline Extended Until Aug 5

How To Find Tax Delinquent Properties In Your Area Rethority

Virginia Property Taxes Not As Bad As Jersey But Worse Than D C Bacon S Rebellion

City Of Richmond Extends Personal Property Tax Deadline To August Wric Abc 8news

Virginia Localities Pushing Tax Relief As Car Values Go Up Dcist